Below is an online spreadsheet that calculates the weekly rates for the common percentages of disability, weeks between two dates – including non-standard work weeks, workers’ compensation awards and reduced earnings. It accounts for statutory minimums and maximums. Directions are below the spreadsheet.

For general information about Workers’ Compensation, click here.

You can enter data into any of the colored cells. The numbers you enter will not save and will be lost when you leave of refresh the webpage.

To Start

- For all calculations enter the date of accident and average weekly wage in the yellow-orange cells in the upper right (cells D117 and D118). The DOA is required since the spreadsheet accounts for weekly minimum and max rates.

- Once you enter the DOA, the max and min rates will autofill into cells G118 and I118

- I will try to update the spread sheet with the new minimum and max rates as that information becomes available. You can manually enter the new minimum and max rates into cells G118 and I118 if needed.

Rate Calculator

- Once you fill in the DOA and AWW, the commonly used weekly rates will be displayed in row 120.

- To calculate a different rate, just enter the percentage into cell N119 (where it says “% to $”). The rate will be displayed below.

- To calculate the percentage of disability from a weekly rate, enter the weekly rate into cell O119 (“$ to %”), and the percentage will be listed below.

Awards Calculator

- To calculate awards for a given period of time, start by entering the start date and end date in row 122 under “To” and “From” respectively.

- The number of weeks will be displayed in row G under “Weeks.”

- Optional: You can adjust the pass days in Row F under “Pass day.”

- The days of the week are listed as MTWTFSS with pass days represented by a 1 and workdays represented with a 0.

- For a worker working Monday through Friday their workweek would be written as 0000011 — this is the default.

- For someone who works Mon to Thurs, and has Sat, Sun, and Mon off their work week should be written 1000011.

- The days of the week are listed as MTWTFSS with pass days represented by a 1 and workdays represented with a 0.

- Enter the % of Disability in Column I under “Disb %.”

- You do not need to enter a percentage of disability if you enter earnings in Column J, since the reduced earnings calculations will supersede the disability rate.

- To calculate reduced earnings, enter the claimant’s wages earned in the entire period in Column J under “Earnings.”

- Once you enter the earnings, the weekly earnings and the difference between the AWW and the weekly RE will be displayed in columns K and L under “Erngs/wk” and “AWW – Earn/Wk” respectively.

- The RE benefit rate will display in column N under “Rate/wk w Caps&Min.” This is adjusted for the statutory minimums and maximums.

- If you enter a rate in column N, that rate will be used instead of the calculated rate to determine overall awards.

- Apportionment can be addressed in several ways:

- If you enter a percentage into cell N131 (the light blue cell), the rates from column M will be multiplied by that percentage for all ten rows of award calculations.

- You can apportion a single rate as you would will any excel formula by multiplying the rate from column N by the apportionment percentage.

- Eg. For 50% apportionment in row 122 you would need to enter the following into cell N122: =M122*50%.

- You can manually enter the apportioned rate in column N

- The overall awards will be displayed in column O under “Award.”

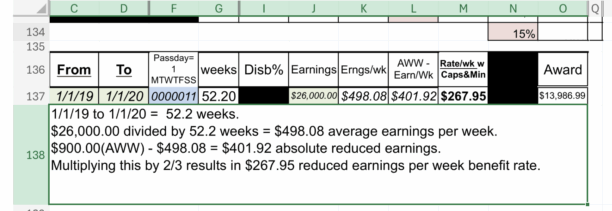

Reduced Earnings Calculator

Although reduced earnings can be calculated in the Award Calculater discussed above, it is helpful to be able to explain each step of the reduced earnings calculations. Entering the data into the RE calculator tool, and it will show each step of the RE calculations. You can the select that cell and copy (control-c) and paste (control-v) whoever you want.

Leave a Reply

You must be logged in to post a comment.